SoFi Stock Price Prediction 2030: An In-Depth Forecast for Investors

SoFi Stock Price Prediction 2030: An In-Depth Forecast for Investors

Since the IPO, SoFi Technologies Inc. (SOFI) has attracted much interest because of the mobile-first, AI-driven fintech platform. As time goes on many investors are beginning to ask themselves where are the SoFi stock price prediction 2030 and what are they all about? Here find potentials future predictions for SoFi’s growth and all the aspects affecting the company’s stocks giving a simple and detailed insight to the interested parties.

Table of Contents

- Introduction to SoFi Technologies and its Market Position

- A Look at SoFi’s Stock History

- SoFi Stock IPO and Early Trading

- Factors Influencing SoFi Stock Price Prediction

- Financial Performance and Growth

- Market and Industry Trends

- Competitive Landscape

- SoFi Stock Price Forecasts for 2030

- Projected Price Ranges

- Bullish vs. Bearish Predictions

- Comparing SoFi Stock Predictions to Other Fintech Stocks

- FAQs

- Conclusion

1. Introduction to SoFi Technologies and its Market Position

SoFi Technologies, Inc. is a financial technology company which provides products such as student, personal loans, investing, credit, and banking. The firm has a highly innovative operational model, offering its services primarily via the internet with consumers seeking simple and efficient financial solutions.

2. A Look at SoFi’s Stock History

SoFi Stock IPO and Early Trading

So, SoFi actually started its operational activities in the market and began work on its IPO only in 2021, though it offered the investment solution in the media space with immense expectations, and investors and analysts took an interest in it. The SoFi stock IPO laid down the course since its beginning, determining its initial market capitalization necessary to bring its exponential growth across diverse operations.

3. Factors Influencing SoFi Stock Price Prediction

Several core factors play a significant role in SoFi stock price prediction 2030 estimates, affecting how analysts view the company’s long-term potential.

Financial Performance and Growth

In latest period SoFi has shown promising results in term of its financial growth and high revenues from diversified services. Some of the factors contributing to this growth include:

- Revenue Streams: Origination of loans, financial service as well as technology platform services are the sources of revenue for SoFi hence diversification of the various revenues makes this company less sensitive to a particular source of revenue.

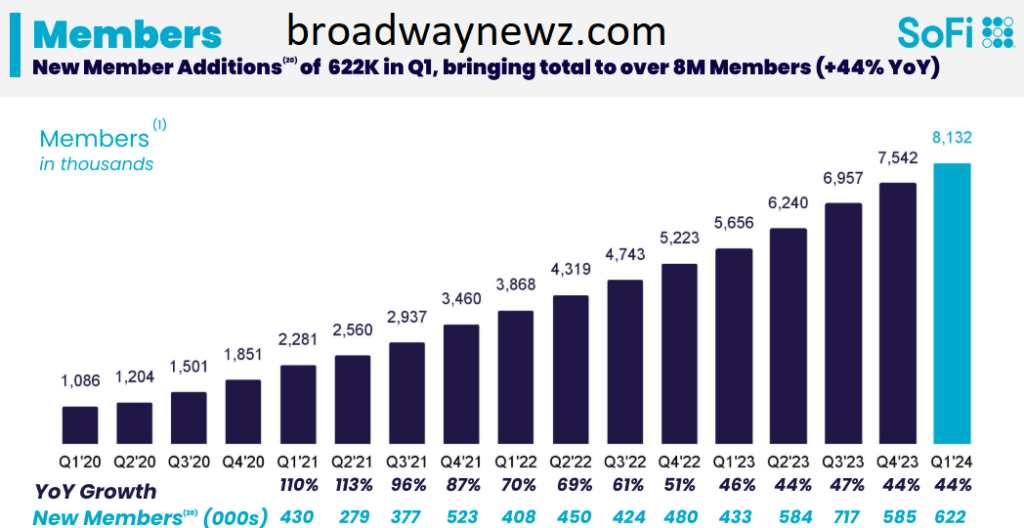

- User Growth: SoFi has amassed tens of millions of users to its network to ensure it has a constant flow of customers who use all its services.

Market and Industry Trends

As a fintech, SoFi benefits from a growing trend towards digital banking and financial services, particularly among younger generations. Key trends that influence SoFi stock forecast include:

- Rise in Fintech Services: The global shift toward digital financial management is expected to continue, positioning SoFi well within a growing market.

- Interest Rate Impacts: Interest rates have a direct effect on SoFi’s loan origination profits. Low rates can boost borrowing demand, while high rates can lower the number of loans.

Competitive Landscape

It is a very competitive industry, with a large number of mega banks and specialized fintech firms looking to gain that market. SoFi’s competitors include traditional banks, emerging fintech companies, and other financial technology firms, such as:

- Traditional Banks like JPMorgan and Wells Fargo

- Fintech Rivals including Robinhood, PayPal, and Square

4. SoFi Stock Price Forecasts for 2030

Now let’s move toward the various sources of SoFi stock price prediction 2030 predictions.

| Forecast Provider | Projected Price for 2030 | Notes |

|---|---|---|

| Coincodex | $18.02 | Moderate growth projection based on the company’s current performance. |

| Wallet Investor | $4.81 | Conservative forecast with potential concerns over competition and market volatility. |

| Other Analysts’ Average | $8.68 | Mixed opinions with growth potential in the long term. |

Projected Price Ranges

Here’s an overview of the high and low price predictions for SoFi’s stock in 2030:

- Bullish Scenario:Raising the bar, a better outlook put SoFi at $40 to $50 per share if the firm is to sustain innovation, increase market share, and scale its revenues significantly.

- Bearish Scenario: Conservative projections predict a stock price around $4.81, which factors in economic slowdowns, high competition, or potential disruptions in the fintech industry.

Bullish vs. Bearish Predictions

Here is the bearish times and bullish times of SoFi stock price forecast, the long-term holder would be benefited investing in it. Early growth investors targeting lower, sustainable, and slow growth will find the lower numbers useful, whereas later investors with a focus on growth will gravitate toward the higher figures.

5. Comparing SoFi Stock Predictions to Other Fintech Stocks

For investors considering SoFi stock price alongside other fintech companies, here’s a comparison of potential 2030 projections:

| Company | 2030 Projected Price (Optimistic) | Market Position | Growth Potential |

|---|---|---|---|

| SoFi Technologies | $40 – $50 | Growing Fintech | Strong user base, diversified services |

| Robinhood | $30 – $45 | Established Fintech | Focused on retail investors |

| PayPal | $250 – $300 | Leading Fintech | Wide range of digital payment options |

| Square | $400 – $500 | Major Fintech | Comprehensive merchant services |

6. FAQs

Q1: What is the SoFi stock price prediction for 2030?

The SoFi stock price prediction 2030 is slightly different depending on the approach used, with more pessimistic values of $4.81, and optimistic 40 to 50 dollars.

Q2: What was the SoFi stock IPO price?

The SoFi stock IPO entered the market via a SPAC merger, with shares initially valued around $10. Its subsequent growth and price fluctuations have reflected SoFi’s expansion into a wide array of financial services.

Q3: What factors could impact SoFi stock price in the coming years?

In this case, market routs, and the interest rate are possibilities that can affect the SoFi stock price over time depending on the position of the company’s stock in the over-the-counter market Since there is competition in the fintech industry, the stock prices are dependent on the specific company and possibly SoFi’s capacity to attract users and increase the retention rate of existing ones.

Q4: Is SoFi considered a safe investment for 2030?

Thus, SoFi has its advantages and disadvantages, which are inherent in the company because of the fact that it works in a very intensive segment of the market. For those who would prefer long-term gains in the value of their stocks, there may be growth possibilities, but those who would prefer lower fluctuations in stock value may wish to be aware of the broad diversification that is offered.

Q5: How does SoFi compare to other fintech stocks?

Compared to other fintech companies like Square and PayPal, SoFi stock may offer a relatively more affordable entry point with potential growth opportunities, although it operates with a smaller market share and narrower focus.

7. Conclusion

Based on the business development and the emerging financial innovation in the SoFi stock price prediction for 2030, there is an enormous potential for future volatility. While some of those projections hint at strong growth, others warn of SoFi’s competition and market volatility. Especially for long-term investors, SoFi is an opportunity to become an even larger company and a very good example of high fluctuations within the stock market. Just as all the components of investment, identifying risk appetite, market trends, and personal financial objectives will be critical when deciding on SoFi stock price in its portfolio.